A brief history for those overseas, Labor and the Greens have been calling for a royal commission into Australia's banks for 18 months, the gov insisting over and over that there was no need for it. Voting against it in parliament over 20 times. Turnbull finally gave in when the National party in coalition with his party insisted on having one. Dragged kicking and screaming to set one up.

Trying to once again use a royal commission for political point scoring, the gov expanded the terms of reference to include union run and industry super funds. Of which I'm a part of BTW being Australian Super. After months upon months of insisting there was nothing wrong with the banks, they thought they might catch evil unions somehow.

Their clever plans however have spectacularly backfired on them. Even National party ex deputy PM Barnaby Joyce has apologised for being opposed to one. The commission has barely got started and it's been revealed they're a punch of crooks. Charging for services not received. 75% of financial advice given by bank financial advisors were detrimental to the client so the bank could line it's pockets. Charging people financial fees when they were dead. One man dead for 10 years.

The public is aghast and up in arms, crying jail them! The intended tax cits to corporations now have a stench of death about them, with nearly $10 billion of those cuts to the very same banks right up shit creek presently. Surely it will have no chance of ever passing the senate now.

And along comes Kelly O'Dwyer, denying everything on todays telly. It was the train wreck of train wreck interviews. Like something out of Monty Python. It was excruciating to watch, but the best bit comes at the very end. The last thing she says is "Let's be a little bit real".

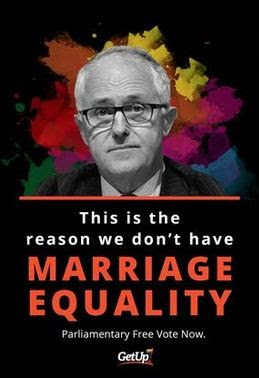

Turnbull voted 22 times to stop the Royal Commission. Now he wants to give the big banks a $13 billion corporate tax cut. What planet is he on? #ausunions #auspol #BanksRC pic.twitter.com/4HKJBaJS4G— Australian Unions (@unionsaustralia) April 23, 2018

Update: from the Blot report:

The Labor Party announced in early 2016 that if it won office in the 2016 election, it would hold a Royal Commission into the banking and financial services industry3. However, it didn’t win the election and the Coalition had been very much against the concept. For instance, as you would expect, Scott Morrison hammered Bill Shorten and the Union movement in stating: For Bill Shorten to go down this path, I think it is a reckless distraction that puts at risk confidence in the banking system, and dismissed it as playing “complete politics” prior to the election3. Morrison also stressed that the banking industry was well regulated in saying “We have a tough cop on the beat in that area – it is called ASIC. We have a strong regulator – it is called APRA. We have the Reserve Bank which provides a broader framework in which the banks operate in (sic). Our banking system is well regulated”.

Just before the 2016 federal election, Prime Minister Malcolm Turnbull wrote to Opposition Leader Bill Shorten asking him to drop his calls for a Royal Commission, instead announcing the laughable prospect of the CEOs of the big banks being brought before a parliamentary committee once a year to explain their decisions. This idiotic idea was rightly pilloried. Turnbull stated that a Royal Commission would only “delay action and postpone reform”.

The out of her depth Minister for Revenue and Financial Services, Kelly O’Dwyer, claimed that a Royal Commission would simply “go over old ground and would delay well developed and important reforms” and that it would “send the signal internationally that the government believes there are structural problems with our banking and financial system and could lead to significant repercussions for confidence, international investment and our AAA credit rating”. The Blot report

No comments:

Post a Comment